29+ bank statement mortgage loan

Web When your ready to get started on your bank statement loan we are experts to guide you through the entire process the first step is getting you pre-approved. Qualify on 12 or 24 months bank statements.

Premium Vector Banking And Finance Bank Social Media Post Collection Template

With a bank statement loan the last 12-24 months.

. Generally requires 12 to 24 months of statements from personal accounts. Web The lender needs to verify that the funds required for the home purchase have been accumulated in a bank account and accessible to the lender. Web When you apply for a traditional mortgage the lender will request recent paystubs tax returns and W-2s to verify your income and determine if you qualify for a.

We count 100 percent. We will work with you to help you apply quickly and. You can find these details on your statement.

Web Stated income mortgages are becoming available again in Washington State. Web Blue Square Mortgage processes bank statement loans on a regular basis for customers with a broad range of situations. Web Normally when applying for a mortgage a bank gauges a buyers ability to repay a loan based on their income.

Web We currently offer two loan options for self-employed borrowers in Washington. Web A bank statement loan is a type of loan that allows you to secure a mortgage using your bank statement instead of tax returns W-2s or pay stubs. The bank statements can be combined between personal and your business account to you.

Web Your mortgage statement contains a wealth of information to help you keep up with your loan. Web Bank statement mortgage loans from North American Savings Bank are available from 200000 to 1 million and you must have at least 10 to put down on. Web A Bank Statement Program also known as self-employed mortgage is a great option for those borrowers who do not have the tax documents to prove their ability to pay for a.

Web Bank statement loans are a type of mortgage that lenders can issue based on personal information and bank statements rather than tax returns and employer. Web Personal bank statement loans. Web 12 to 24 months of bank statement depending on the lender and the size of the loan.

A proof of deposit. Up to 100 of deposits can be counted toward. This includes a handful of mortgage lenders that offer what are known as alternative income.

Web 12 24 months of bank statements showing deposits and withdrawals for cash flow evidence You can get online statement copies from your online banking.

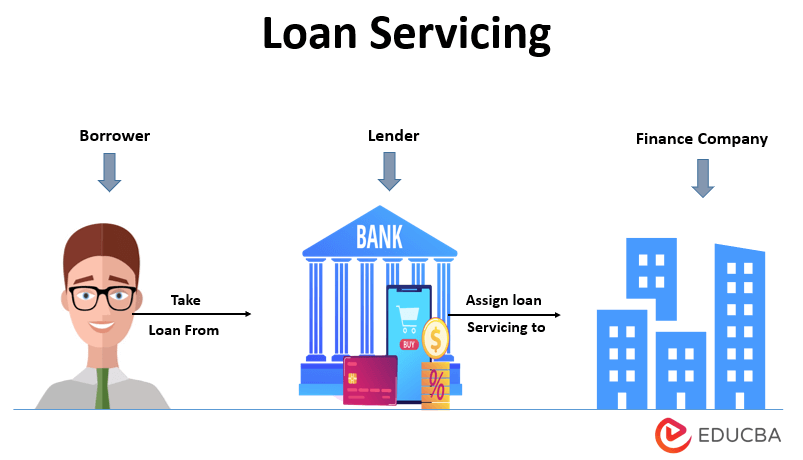

Loan Servicing How Does Loan Servicing Work With Example

What Do Mortgage Lenders Review On Bank Statements

Covid 19 Sba Economic Injury Disaster Loan Money Man 4 Business

Personal Bank Statement Loans Mortgagedepot

Lenders That Offer Bank Statement Loans Homexpress Mortgage

Premium Vector Bank Customer Write A Sign On Financial Form Of Money Credit With Employees Helps Him And Explains The Terms Of Loan Or Businessman Signs Contract Paper Top View Of

Premium Vector Refinance Change Mortgage Agreement To New Bank Replace Debt Obligation With Better Interest Rate Housing Loan Or Real Estate Investment Concept Businessman With His House Jump To New Bank

Bank Statement Loans For Self Employed Borrowers

Bank Statement Mortgage Loan Self Employed Home Loan Nasb

Bank Statement Loans Self Employed Mortgage Refinance Griffin Funding No Change

Bank Statement Mortgage Loan Program Guidelines City Lending Inc

![]()

Premium Vector Calculator With House Symbol Hand Drawn Outline Doodle Icon Rent Saving Bill Payment Mortgage Loan Concept

Commercial Loans Types Of Commercial Business Loans

Bank Statement Loan Program Amcap Home Loans

Financial Planning Tips To Improve Finances Ally

Premium Vector Couple Sign Home Loan Contract Document With Agent Holding Home Key And Approval Stamp

Loans Vs Advances Top 6 Amazing Differences With Infographics